Governmental Transgression of the Eighth Commandment

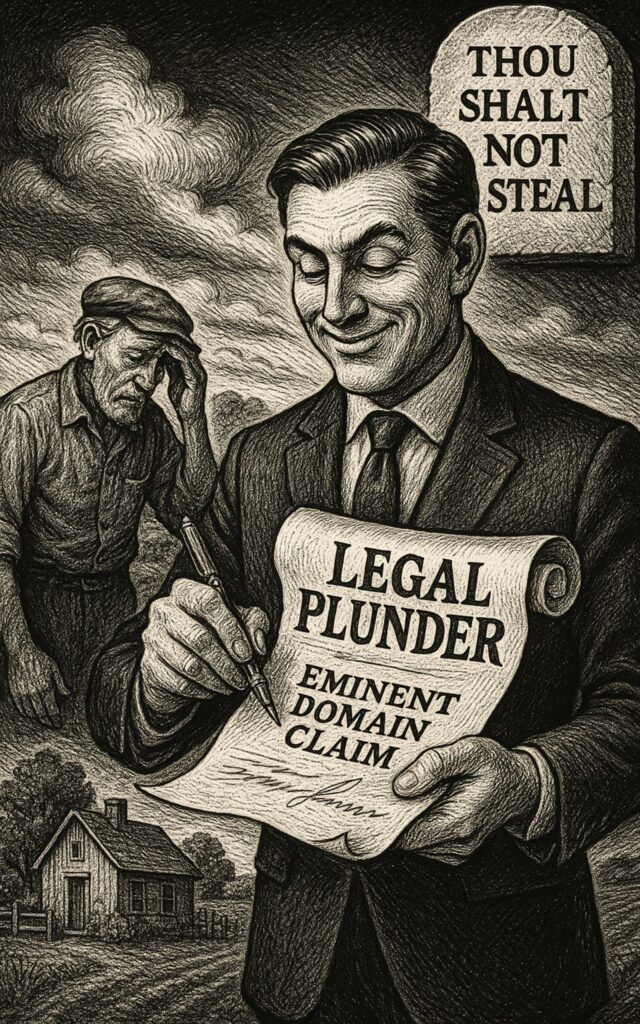

This document synthesizes an in-depth theological and political analysis of the eighth commandment, “Thou shalt not steal.” The central thesis is that this commandment extends far beyond personal theft to condemn systemic, legalized plunder perpetrated by governments. This governmental theft is presented not as an isolated failing but as a direct reflection of the moral character of the populace, which has broadly rejected divine law in favor of self-serving, “feel-good” ideologies.

The analysis draws heavily on the 1850 treatise The Law by Frédéric Bastiat, which posits that modern law has been perverted from its purpose of protecting liberty and property into a weapon for organized plunder. This “legal plunder” manifests in numerous government policies, including a fraudulent monetary system, eminent domain, property taxes, public schools, and a graduated income tax. These mechanisms are described as “sophisticated” forms of theft that effectively strip citizens of true property ownership, rendering them tenants on land ultimately controlled by the state. This system is contrasted with the “perfect” law of Yahweh, under which only the increase from property is taxed (the tithe), ensuring no one can be dispossessed of their inheritance. The conclusion asserts that a reversal of this trend is impossible without a fundamental change in the hearts and minds of the people, leading them back to the divine laws they have abandoned.

The Perversion of Law and the Principle of Reflection

The core argument posits that a government’s character is a mirror of the people it governs. Widespread transgression of divine law by the citizenry inevitably results in a government that institutionalizes these same transgressions.

The Reflection Principle: Like People, Like Government

The analysis contends that the morality of a government is a direct reflection of the hearts and character of its people. This principle is supported by biblical scripture:

Hosea 4:9: “And there shall be, like people, like priests.” This is interpreted to mean that the character of the leadership originates with the populace, not the other way around.

Isaiah 1:23: “Thy princes are rebellious and companions of thieves.” This suggests a collaborative relationship in corruption between rulers and the ruled. 2 Timothy 4: Paul’s warning to Timothy is cited as an example of people actively seeking leaders who reflect their own desires—specifically, leaders who will “tickle their ears” with “feel-good messages” rather than reprove them with divine law.

This desire for entertainment and self-affirmation has led modern churchgoers to become introspective and selfish, focusing on “what can the church do for me” instead of “what can I do for my king and his kingdom.” This rejection of the entirety of God’s law, including its statutes and applications, enables a government that also rejects this moral framework.

Frédéric Bastiat and the Concept of Legal Plunder

The 1850 treatise The Law by French writer Frédéric Bastiat provides a foundational concept for the analysis: the perversion of law into a tool for theft.

“The law perverted! And the police powers of the state perverted along with it! The law, I say, not only turned from its proper purpose but made to follow an entirely contrary purpose! The law became the weapon of every kind of greed! Instead of checking crime, the law itself is guilty of the evils it is supposed to punish!”

Bastiat’s argument is that the law, whose proper function is to defend person, liberty, and property, has been repurposed to violate them.

“The law has been used to destroy its own objective. It has been applied to annihilating the justice that it was supposed to maintain; to limiting and destroying rights which its real purpose was to respect. The law has placed the collective force at the disposal of the unscrupulous who wish, without risk, to exploit the person, liberty, and property of others. It has converted plunder into a right, in order to protect plunder. And it has converted lawful defense into a crime, in order to punish lawful defense.”

This “legal plunder” is organized through an “infinite number of plans,” including:

- Tariffs

Protectionism

Benefits and subsidies

Progressive taxation

Public schools

Guaranteed jobs and profits

Minimum wages

Free credit

Manifestations of Systemic Governmental Theft

The document details numerous specific mechanisms through which the government allegedly engages in legalized theft, systematically eroding citizens’ rights to property, labor, and wealth.

The Erosion of True Ownership: Land and Property

A central claim is that true private land ownership has been effectively abolished in America, with citizens reduced to the status of tenants under the ultimate ownership of the state.

Eminent Domain as a Claim to Sovereignty: The doctrine of eminent domain is presented as the government’s claim to original and absolute ownership of all property, predating any individual possession. A quote from the 1915 book Ruling Case Law explains this theory, stating the state possesses “ultimate ownership” and can resume property at will. This is framed as a usurpation of Yahweh’s divine sovereignty, as He alone has true eminent domain over the earth. The mere existence of this government power, regardless of how often it is used, proves that individuals do not truly own their land.

Property Taxes as Feudal Rent: Property taxes are characterized as a “feudal rental fee” that demonstrates a lack of true ownership. A modern-day parable by Bob Holstrom is used to illustrate this, comparing government tax collectors to “slickly boys” from the mob demanding protection money. Failure to pay this “extortion fee” results in the loss of the property, proving the state has a superior right of ownership. This logic is also applied to vehicle registration fees.

“Public Lands” as Stolen Property: The concept of “public lands,” such as national parks, is described as a deceptive misnomer. These lands are argued to have been confiscated—stolen—from private owners. The fees required for entry and the tax dollars for maintenance underscore that these lands are not truly owned by the public but by the government, an entity never intended by Yahweh to be a property owner.

Financial, Economic, and Social Plunder

The analysis extends beyond land to include currency, national debt, and even human labor as objects of governmental theft.

Fraudulent Monetary System: The modern monetary system is labeled a fraud. It is argued that “real money”—substantive assets like gold and silver—has been stolen from the people and replaced with debased notes that are no longer backed by anything of value. The very definition of the word “money” has been debased along with the currency itself.

National Debt: The national debt is cited as proof of a fundamentally inequitable economic system. Specific data from May 3, 2004, is provided to illustrate the scale of the problem: | Metric | Value (as of May 3, 2004) | | :— | :— | | Outstanding Public Debt | $7,086,321,012,265.50 | | U.S. Population (Est.) | 293,955,011 | | Each Citizen’s Share | $24,446.95 | | Average Daily Increase | $1.87 billion (since Sept. 30, 2003) |

Theft of Labor and Progeny (1 Samuel 8): A parallel is drawn between the warnings of the prophet Samuel to the Israelites clamoring for a king and the actions of modern government.

Military Draft: Taking sons for chariots is equated with the modern draft.

Military-Industrial Complex: Appointing captains and making instruments of war is likened to the military-industrial complex.

Theft of Labor: Taking servants and young men for “his work” is compared to federal work programs.

Confiscation of Property: Taking fields and vineyards is linked to property taxes and eminent domain.

The Graduated Income Tax: Taking a “tenth of your seed” is seen as a precursor to the modern income tax, which has become far more burdensome than a simple tithe. The graduated income tax is also identified as one of the ten planks of the Communist Manifesto.

“Sophisticated” Theft

The modern government’s methods are described as more “sophisticated” than the overt theft of a ruler like King Ahab, who confiscated Naboth’s vineyard. An analysis of the historical definition of “sophisticated” is provided to support this claim:

Definition 1: “To alter fraudulently, usually for profit.”

Definition 2 (Webster’s 1828): “To adulterate; to corrupt by something spurious or foreign.”

Definition 3 (Webster’s 1828): “The act of adulterating; a counterfeiting or debasing the purity of something.”

These definitions are applied to the government’s actions, characterizing them as a complex, fraudulent, and debased system of plunder that is difficult for the average person to comprehend.

The Contrast with Divine Law

The analysis concludes by contrasting the burdensome and destructive nature of man’s tax systems with the equity and justice of Yahweh’s law.

Yahweh’s Tax System: Under divine law, only the increase from one’s property was to be taxed (the tithe). This system is presented as perfect for several reasons:

1. No Dispossession: Since only prosperity is taxed, no one would ever lose their property for being unable to pay taxes during a difficult year.

2. Equity: Only those who have an increase are required to pay, protecting the poor or those suffering adversity.

3. Fairness: The tax was a flat 10%, never to be exceeded. It was not graduated to penalize incentive.

4. Promotes Improvement: This system encourages the development of property, whereas property taxes contribute to neglect and mismanagement, as cited by author R.J. Rushdoony.

Man’s Burdensome System: In contrast, modern tax systems are a “stumbling block to prosperity.”

Taxing Property: To tax property itself, rather than its increase, is to make it a liability instead of an asset.

Taxing Improvements: This penalizes the industrious and thrifty.

Inheritance Tax: This is described as “gradual or piecemeal theft of yours and your children’s inheritance.”

The final conclusion is that man’s laws, not God’s, are burdensome. The current political and economic state is a direct result of the people’s choices, and it will only grow worse until there is a popular repentance and a return to the perfect laws of God.

The concept of “legalized theft,” or “legal plunder”, fundamentally redefines the government’s role regarding private property by shifting it from a guardian and upholder of private rights to a sophisticated perpetuator and beneficiary of exploitation and confiscation.

This redefinition transforms the government’s stance on property in several critical ways:

Shift from Protecting Rights to Annihilating Them

The proper role of law, or government, is implicitly understood to be upholding justice and respecting individual rights. However, under the system of legalized theft, the law is perverted and made to follow an entirely contrary purpose.

Weapon of Greed and Injustice: The law becomes “the weapon of every kind of greed” and the “invincible weapon of injustice,” instead of checking crime. The law itself is deemed “guilty of its of the evils it’s supposed to punish”.

Conversion of Plunder into a Right: Legalized theft, which is synonymous with plunder, means the government uses its collective force to exploit the person, liberty, and property of others. It converts plunder into a right in order to protect plunder, and converts lawful defense into a crime.

Destruction of Property Rights: The law is applied to annihilate the justice it was supposed to maintain and destroy the rights it was supposed to respect. The intent is to destroy private property for the benefit of those who make the law.

Claim of Absolute Ownership via Eminent Domain and Taxation

Legalized theft redefines the government not just as a regulator, but as the superior owner or claimant of all land, directly contradicting the idea that citizens possess true private property.

Claiming Superior Title: Through the doctrine of eminent domain, the government asserts sovereignty and claims “original and absolute ownership” of all property possessed by individual members of the state, antecedent to their private possession. This claim alone demonstrates that the government has “stolen title of all the land in America”.

Redefining the Citizen as a Tenant/Slave: If the government can exercise its discretion to confiscate or take property at any time, then the citizen who wears a shirt (or owns land) that can be partially “whacked off” by the authority is not truly the owner.

Property Taxes as Feudal Rent: Property taxes demonstrate that the government owns the land. Landowners are merely “temporary tenants” who may be removed if they fail to pay. This system is equated to paying an annual “feudal rental fee”. The failure to pay this fee results in the loss of the property, proving the government, county, or state holds the superior right of ownership.

Property Confiscation as a Tool for Enslavement

The accumulation of property through sophisticated theft serves as a means of control and enslavement over the populace.

Enslaving the Man: Property is basic to man’s freedom. By confiscating, limiting, or heavily taxing property, a tyrannical state achieves an “effective means of enslaving a man, which without necessarily touching his person”.

Economic Deterioration: Taxing property converts it from an asset into a liability. Furthermore, taxing improvements on property penalizes the industrious. The consequence of ever-increasing property taxes is the eventual dispossession of inheritance, as only the “super rich can afford to quote unquote own, possess, or hold property”.

Against Divine Intent: Governments were never ordained or intended by Yahweh to be property owners or land owners. Yahweh’s laws decreed that only the increase from property was to be taxed (the tithe), which would prevent dispossession. The fact that the government taxes the property itself, rather than just the increase, is considered unlawful and evil, stealing from both the people and Yahweh.